Being a trader, it is important to understand the industry actions and take benefit from them. It may be challenging to forecast exactly how the marketplaces will conduct themselves, however with some expertise and the appropriate tools, you may improve the likelihood of achievement. In this article, we shall talk about how you can learn market place actions and be a lucrative trader.

Understanding Marketplace Tendencies:

Before you make any deals, you have to evaluate the current market trends. This includes understanding historical data, figuring out habits, and keeping track of media activities that may impact the markets. By understanding the marketplace trends, you possibly can make well informed judgements about when to enter or get out of deals.

Specialized Evaluation:

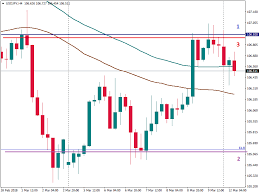

Technical evaluation is a vital tool for forex traders looking to expert marketplace movements. It requires examining maps and making use of indicators such as shifting averages, tendency facial lines, and assistance and opposition degrees to distinguish potential access or get out of things. Technical assessment will also help traders decide where end-reduction orders placed should be positioned to minimize deficits.

Basic Assessment:

Simple analysis involves examining economical data like GDP progress charges and interest levels to calculate how markets will react. Forex traders who use simple examination frequently look at media occasions for example key bank announcements or corporate and business earnings studies that may affect the markets’ direction.

Risk Administration:

Handling hazards is important in trading since it aids traders avoid significant deficits that could wipe out their accounts’ whole equilibrium. An effective chance management technique includes establishing end-damage orders placed at appropriate ranges according to technical or simple assessment.

Emotional Control:

Feelings can travel futures trading review to produce irrational decisions which lead to important losses in trading. Therefore it is essential for traders to maintain emotional control by staying on their trading prepare and avoiding overreacting to quick-word variances from the trading markets.

Verdict:

Understanding market actions needs a knowledge of both practical and simple examination tactics as well as effective danger control and emotionally charged management. By examining market trends, making use of technological and basic examination equipment, controlling risks, and managing sensations, investors can enhance their odds of good results from the markets. Do not forget that trading is actually a trip, and it takes time to build up the relevant skills needed to turn into a profitable trader. Nevertheless, with patience and persistence, anyone can master industry actions.