Trading in the world of finance can be a bit overwhelming. Between stocks, commodities, and currencies, there are countless investment opportunities to choose from. But what if you could easily trade all of these instruments through a single platform, with the potential for big profits? That’s exactly what makes Contract for Difference (CFD) trading so appealing. In this post, we’ll explore what Cfd trading is, how it works, and its profit potential.

First, let’s define what cfd trading is. Essentially, it’s a way of trading the price movements of various financial instruments without owning the underlying assets. When you buy a CFD, you enter into a contract with a broker to exchange the difference in price between the opening and closing price of the asset. If you predict that the price will rise, you buy the CFD (also known as going long), and if you predict that the price will fall, you sell the CFD (going short).

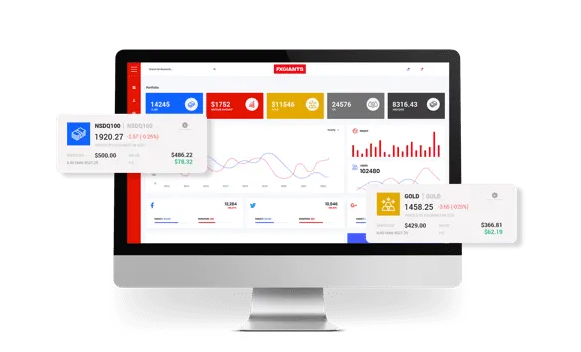

One of the key advantages of Cfd trading is that it allows traders to easily access global markets. With CFDs, you can trade not just stocks, but also commodities, indices, and currencies. This makes it easy to diversify your trading portfolio and capitalize on market opportunities across the world. Additionally, Cfd trading allows traders to use leverage, meaning you can enter into trades with higher values than your account balance. While this can amplify gains, it’s important to remember that it can also increase losses.

So, what is the profit potential of Cfd trading? It’s important to note that, like any investment, there are risks involved. However, one advantage of Cfd trading is that you can make profits both when the price of the asset rises (by going long) and falls (by going short). This means that traders can potentially profit in any market conditions. Additionally, because Cfd trading allows for leverage, even small price movements can yield significant returns.

Another factor that can impact profit potential is trading strategy. CFD traders may use technical analysis to analyze price charts and identify trends that they believe will continue, or fundamental analysis to evaluate the financial health of companies and make predictions about their future stock prices. Some traders also use automated trading software, or even copy other successful traders’ strategies. Ultimately, the key to success in Cfd trading is to have a solid understanding of markets, a disciplined trading plan, and risk management practices in place.

short:

In short, Contract for Difference trading can be a great way to access global markets and potentially profit from the price movements of various financial instruments. While there are risks involved, Cfd trading allows for both long and short trades and can yield significant returns due to leverage. To be successful in Cfd trading, it’s important to have a well-informed trading strategy and a sound risk management plan. With the right approach, investors can unlock the profit potential of Cfd trading and navigate the world of finance with confidence.