The financial landscape is constantly evolving, and one of the most dynamic areas of this evolution is Contract for Difference (CFD) trading. As we look to the future, several trends are emerging that are poised to shape the future of CFD trading. These trends include advancements in technology, changes in regulatory environments, and shifts in trader behavior. Understanding these trends is crucial for traders looking to capitalize on the opportunities that CFD trading offers.

Advancements in Technology

AI and Machine Learning

Artificial Intelligence (AI) and machine learning are revolutionizing the way traders analyze markets and execute trades. These technologies can process vast amounts of data at unprecedented speeds, providing traders with real-time insights and predictive analytics. This allows for more informed decision-making and the ability to execute trades with greater precision.

Blockchain Technology

Blockchain technology is another significant trend impacting CFD trading. The transparency and security offered by blockchain can enhance the integrity of trading platforms, reducing the risk of fraud and ensuring that transactions are carried out smoothly. Additionally, blockchain can facilitate faster settlement times, which is a critical factor in the fast-paced world of CFD trading.

Mobile Trading

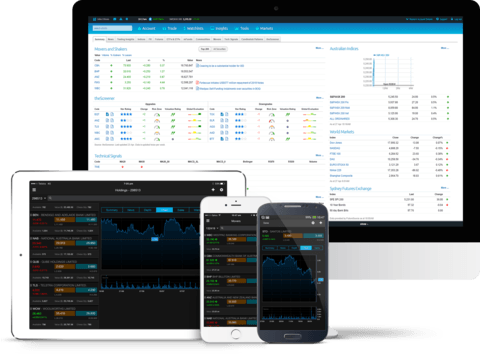

The rise of mobile trading platforms is democratizing access to CFD trading. Traders can now execute trades from anywhere in the world, provided they have an internet connection. This increased accessibility is attracting a new generation of traders who value the convenience and flexibility that mobile trading provides.

Changes in Regulatory Environments

Stricter Regulations

Governments and regulatory bodies around the world are implementing stricter regulations to protect retail investors. These regulations often include measures such as leverage caps and mandatory risk warnings. While these regulations aim to protect traders, they also require brokers to adapt their business models, which can impact the overall trading experience.

Global Standardization

There is a growing trend towards the global standardization of trading regulations. This is particularly important for CFD trading, which is inherently international. Standardized regulations can provide a level playing field for traders and brokers alike, fostering a more transparent and fair trading environment.

Shifts in Trader Behavior

Increased Focus on Education

As the market becomes more sophisticated, there is an increasing focus on trader education. Brokers are offering comprehensive educational resources, including webinars, e-books, and online courses, to help traders understand the complexities of CFD trading. This trend is empowering traders to make more informed decisions and manage their risks more effectively.

Social Trading

Social trading platforms are gaining popularity, allowing traders to share strategies and insights with one another. This collaborative approach to trading can provide valuable learning opportunities and foster a sense of community among traders. Platforms that facilitate social trading are likely to see increased engagement and loyalty from their users.

Ethical Investing

Ethical investing is becoming more prominent across all areas of finance, including CFD trading. Traders are increasingly considering the ethical implications of their investments, choosing to support companies and industries that align with their values. Brokers that offer products and services catering to this trend are likely to attract a new segment of traders who prioritize ethical considerations.

Conclusion

The future of CFD trading is bright, driven by technological advancements, regulatory changes, and evolving trader behaviors. Traders who stay abreast of these trends and adapt their strategies accordingly will be well-positioned to capitalize on the opportunities that CFD trading offers. As the landscape continues to evolve, the key to success will be staying informed, being adaptable, and leveraging the latest tools and technologies to enhance trading performance. Whether you are a seasoned trader or new to the world of CFDs, understanding these trends will help you navigate the future of finance with confidence.