Metatrader 4 is amongst the most widely applied forex trading programs around the globe. With its powerful functions and user-helpful user interface, it has become a popular of the latest investors along with professional dealers. However, in case you are a novice to Metatrader 4, it may be a little overwhelming to get going. That’s why, in this post, we will supply you with a thorough manual on the way to master Metatrader 4.

1. Comprehending the Interface:

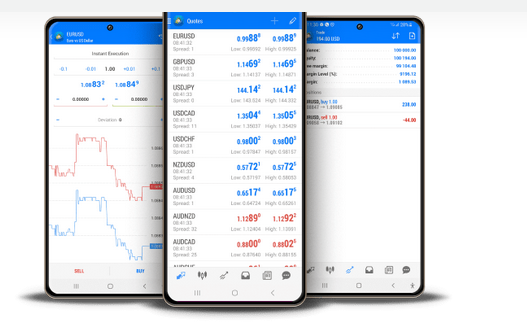

Before we plunge in to the technicalities of Metatrader 4, you should comprehend the basic graphical user interface. Metatrader 4 is a program that provides traders with usage of a trading market, charting tools, and a range of indicators. The program is divided into four main regions, which are the Market place Watch, the Navigator, the Graph Windows, and the Terminal Home window. The Current Market Watch screens various economic equipment with all the current wager/request value. The Navigator is where traders can access their bank account and indicators even though the Chart Window is the place where investors can observe graphs in their chosen belongings. The Terminal Windows is where information about the account industry past and open up placements is exhibited.

2. Setting up Metatrader 4:

Step one towards learning Metatrader 4 is always to download and put in the system on your pc or portable. You are able to download Metatrader 4 in the formal website and keep to the installing recommendations provided. Upon having set up the system, you are able to sign up for a demo profile and rehearse trading using internet funds.

3. Comprehending Charting Instruments:

One of several important benefits of Metatrader 4 is its charting tools. Dealers can evaluate the industry and build forex trading techniques with such instruments. The program supplies various chart kinds, which includes candlestick, range, and bar maps, that can assist traders understand value moves precisely. Forex traders also can use different time frames to assess selling price alterations and recognize industry developments.

4. Customized Signs:

Metatrader 4 allows dealers to make use of custom signals which can help them analyze the current market better. These signals are mainly specialized indications that use statistical estimations to distinguish support and level of resistance levels, momentum, and craze durability. To utilize a customized signal on your own graph or chart, you should import it into Metatrader and attach it for the graph.

5. Automated Forex trading:

Metatrader 4 works with automated trading, that is a special attribute in the foundation. Investors can get their trading techniques using the built in Specialist Consultant system or use 3rd-get together Specialist Advisors. Automatic trading permits dealers to complete deals based upon pre-outlined requirements and eliminates individual feelings from investing.

Conclusion:

Metatrader 4 is a superb forex trading platform which offers use of a huge selection of charts, indicators, and tools. It supports both manual and computerized forex trading and is user friendly, so that it is among the go-to systems for investors. Hopefully this complete guide will allow you to understand Metatrader 4’s highly effective functions and get going with forex trading on the foundation. Recall, exercise is crucial to understanding Metatrader 4, so make sure you process and develop your investing tactics before trading with actual money. Delighted forex trading!